Considerations When It Comes to Bill Payment Kiosk

March 11, 2019

A bill payment kiosk improves revenue and reduce labor costs, but only if deployed correctly

The Bill Pay Kiosk, Underbanked and Unbanked in 2019

There are all sorts of situations where a company needs to accept regular payments from their customers. Utility payments, cellphone bills and store credit cards are just a few of the situations where customers make regular payments.

And if one thinks that the ability for those organizations to accept payments via their website, mobile or by mail has eliminated the need for other payment options, they’d be mistaken. Some example payments include Alimony, Rent payments, Healthcare co-pays, mobile phone payments, cable TV bills, money transfers, tuition payments, and correctional facility services.

Others include cell phone top-ups, long distance, and digital phone cards for International calls. There are international payment options available as well, especially for Latin Amerian countries like Mexico, where for example the customer can pay his mother’s Telmex bill in California.

And how these payments are made are important to note. As much as Check21 did to simply checks, that is still a major form of payment depending on the venue. You have cash payment terminals running $5000 a day in some locations. And then there is a credit card and mobile.

Unbanked and Underbanked Statistics

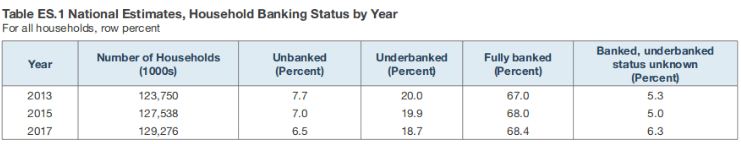

According to a recent survey

conducted by the Federal Deposit Insurance Corporation, more than 8.4 million households in the United States are unbanked, meaning they don’t have access to a checking or savings account. Other data points to at least 50 million unbanked. Another 24.2 million households are underbanked, with access to a checking or savings account but also making use of financial products and services outside of the banking system. Together, more than a fourth of U.S. households are unbanked or underbanked.

There are specific geographic and demographic data outlining these groups. Ethnic and cultural factors play into it with some cultures preferring cash.

Having a reduced set of payment options for what can be a very large customer set doesn’t help retain and create more customers. The end result of adding bill payment options ultimately increases the cash flow for companies and expands their consumer base.

In addition, a significant portion of the population, primarily lower-income and younger people, still prefers to conduct their business in cash. Maybe they don’t trust the banking system. Maybe they tend to pay bills closer to their due date and don’t want to risk a late payment or service cutoff. A personal US Mail check or money order may be delayed. Maybe they want to wait till the last moment during the “last chance” before penalty phase. It could be a language. Add to that the 11 percent of U.S. adults who don’t use the Internet, according to

a Pew Research study, and it’s clear there will always there will always be a need to provide payment options to customers.

That’s where a

bill pay kiosk comes into play.

The benefits of adding a bill pay kiosk to an organization’s payment options are many. For the customer, those include few service disruptions, improved credit and fewer reconnect and/or late payment fees. The kiosks in a way become the financial center or “bank” for the underserved, which they know the bank has ignored them. For the organization, they include more timely payments, fewer trips by a technician to reconnect service that was cut off, lower staffing needs at the payment center, fewer trips to payday loan, check cashing centers where they used to go before the kiosk, and overall much improved customer satisfaction. That translates to higher retention of existing customers and a higher acquisition rate of new customers.

Still, accepting payments by kiosk isn’t just a matter of setting up a device in the headquarters lobby and hoping for the best. Here are a few considerations to take into account when deploying a bill pay kiosk.

Bill Pay Machines Make it easy

By a large margin, those people who don’t use the Internet are 65 or older. Some of the main reasons, they say, are that it’s too difficult and they believe they’re too old to learn. If the kiosk application is too difficult to use it’ll be the same reason they give for avoiding it.

Incorporate large fonts and a logical payment process for the interface to make the kiosk easy on the eyes and the brain. Incorporate a simple way to start the process over if the user makes a mistake. It won’t hurt to have a staff member nearby during the first few weeks after initial rollout to assist first-time users. Kiosk technology also makes it easy to incorporate a variety of languages; make sure you include those options, especially if the unit will be located in a culturally diverse area. Users will appreciate it.

Publicize the option

Include marketing materials about the new bill pay kiosks with bills, in print ads, on TV commercials, and on your website. Also have office staff inform customers who come in to pay their bills about the devices, and offer to guide them through the payment process.

Add additional locations

One of the beauties of kiosk technology is that it allows organizations to expand their footprint without the capital costs of a brick-and-mortar location. In addition, we now live in a world where people expect to be able to conduct business at any hour of the day.

One way to increase the value of bill pay kiosks is to place them in areas where customers can access them at any time of the day or night, in a place that’s convenient for them. Along with placing a kiosk in the lobby of the central office, consider placing units in grocery stores or other 24-hour locations. This would be especially important when a significant number of customers live in rural locations.

Making sure that the right biller is available in the right geographic area is important. Utilities get the biggest use, and they’re the “magnet” effect if you are pulling the customers into paying their utility bills. Once the customer is there, they can see an array of options for paying their cable, wireless phone, and stored value cards like VISA & MC prepaid cards

Philadelphia just became the first large city in the nation to ban cashless businesses in the city, in part to protect people like Dwight Tindal, a construction worker who doesn’t have a bank or credit card. Protecting The ‘Unbanked’ By Banning Cashless Businesses In Philadelphia

27 percent of U.S. households do not have regular access to banks and other mainstream financial services.

That’s 90.6 million financially marginalized people who are further penalized, in terms of time and money, by having to rely on alternate financial services (AFS), which charge fees for transactions that are often free to customers of banks, credit unions and other federally insured institutions. Despite the financial recovery since the Great Recession and the growth of online financial services, the number of households with little or no access to bank accounts has remained stubbornly steady since 2009, when the FDIC began collecting statistics on the phenomenon.

Theresa Schmall, a manager at CFSI, points out that “solutions using digital and mobile platforms can provide expanded access” for the unbanked. It may also remove the presumption of exclusivity that prevents many unbanked and underbanked households from approaching mainstream financial services — while also eliminating those seemingly endless lines.

Make it reliable and secure

Nothing will frustrate customers more than a kiosk that’s out of order when they need to pay a bill. If it happens more than once, you’ve likely lost them as kiosk customers forever. Invest in a solution that incorporates quality, reliable hardware.

One the same note, make sure the kiosk hardware and software is secure from tampering. The last thing a business needs is the expense and negative publicity that accompanies a data breach.

Partner with an expert

Partnering with an experienced vendor saves you the headaches of learning these lessons on your own. Work with someone that has existing projects and can offer consulting and advice on how to make your project a success. Olea Kiosks stands ready to help.

To get started with a free consultation, call Olea Kiosks today

or contact us online.

Payment Kiosk News

Although it remains to be seen if the use of cash as a form of payment will eventually disappear, don’t expect it to happen any time soon. Consumers used cash in 26 percent of transactions last year, according to the Federal Reserve’s 2019 Diary of Consumer Payment Choice. Although that’s down from 30 percent in 2017, it’s a far cry from total elimination. Another few tidbits from the Fed report: Participants in the study used cash for 35 percent of in-person payments, and cash represented 49 percent of payments under $10. Of all the cash payments reported, the study found, 80 percent were for payments below $25. Underbanked, non-banked and the kiosk industry Well, let’s start with those figures on cash payments. Some of the strongest growth the kiosk industry is seeing these days is in the self-order arena, specifically in fast-food restaurants. Those transactions are typically $20 or less, right in the sweet spot for cash usage. Billpay kiosks are growing in popularity as well, targeting underbanked consumers or those who don’t have the ability to pay bills online. Some of the deployed applications include water bill payment, electricity bill pay, gas bill pay and light bill pay. 30% (and rising) of the US population is lower class living in apartments, renting housing. 25% of the US population is unbanked or underbanked according to a 2017 survey by the Federal Deposit Insurance Corp and that number is considered low. Again, the type of people who are likely to favor cash. So if credit cards are the only payment option, a company that relies on self-service kiosks may be missing out on substantial revenue opportunities. Still, accepting cash does present obstacles deployers need to overcome. And with the use of alternative forms of payment on the rise, deployers need to plan for those as well. Utility Bill Payment Example Eliminating the hurdles Although it’s certainly much simpler to only accept cards as payment, a successful kiosk project is likely to involve the ability to accept cash as a form of payment. “As a business decision, I don’t believe that excluding paying customers is an effective way to win business,” said Thomas Smith, CEO of Providence, R.I-based Self-Service Networks. “If a customer wants to purchase your products and services, there should be no barriers created that would prevent them from making that purchase.” In fact, the ability to accept cash may be critical to a project’s success. Chicago’s Department of Finance, for example, began rolling out self-serve kiosks in 2007, allowing citizens to pay for everything from parking tickets to utility bills. The kiosks accept a variety of payment methods, but 47 percent of those payments are made in cash. “Since the beginning, cash has always been most popular at the kiosks,” Tina Consola, first deputy director of the department, told the trade news website PYMNTS.com. “It’s important to serve customers who primarily pay in cash, because they may not have access to a checking account or credit card.” Aside from the obvious security concerns, one of the main issues when it comes to accepting cash is the quality of the cash itself. Most of us can recall at some point in their lives trying to purchase a soft drink or candy bar from a vending machine, only to see their dollar bill rejected time and time again. “Unless the operator is using a high quality bill acceptor from MEI or JCM, lower quality notes may not be accepted at a high rate, thus reducing revenue generated by the unit,” said Dylan Waddle, chief operating officer with Norman, Okla.-based M3t Financial Services, a provider of cash management software solutions. In addition, the issue of dispensing change presents another challenge (and expense). “It is always easier to round off transaction amounts to the nearest dollar to lessen the burden of dealing with coin,” Waddle said. “Over the past 10 years, M3t has been testing new and innovative ways to deal with coin and even the most sophisticated methods still have issues with coins jamming in transition to the customer,” he said. “Coins also drive a much larger footprint for the kiosk unit itself, so if they can be avoided, it is much preferred.” Cash Collection Other concerns are the expense and time involved in pulling cash from a kiosk and taking it to the bank. At the very least, those tasks can take an hour or more per day, while for busy locations it can mean hiring an armored car service to handle the cash. Whatever the challenge, though, the use of cash isn’t going away. If the kiosk itself doesn’t accept cash, merchants may be forced to provide an alternative payment channel for those who prefer to conduct business with currency. “Legislative pressures forcing brick and mortar retailers to accept cash is definitely a growing trend,” Smith said. “In fact, our beloved Rhode Island is one of the first states (if the only) to pass a law to require cash acceptance at brick and mortar retailers.” And legislation affects insurance for cash services. In Colorado and other states which have legalized marijuana one of the biggest problems is hiring insured cash collection services. There are workarounds but this has put a damper on the cannabis kiosk since most of the transactions are cash. Bitcoin Kiosks – Hidden opportunities? Although accepting cash can certainly complicate a kiosk project, doing so can reap some unexpected benefits. Along with the potential for increased sales, kiosks can simplify the cash management process. “Cash accepting systems can reduce cash shrinkage because employees rarely touch or count money,” said Douglas Shipley, OEM Sales Manager, North America with Glory Global Solutions. Glory is a provider of secure, efficient payment systems, cash recyclers and instant, highly accurate identity verification and authentication solutions. “Glory cash automation machines accept, count, sort and dispense change while keeping an accurate accounting of cash on hand,” Shipley said. “Counterfeit bills detection is also built in.” The addition of cash acceptance to self-serve kiosks also speeds realization of revenue because the funds may be immediately available for deposit, Shipley said. Credit card payments, on the other hand, require processing time as well as the imposition of fees by banking institutions. Although accepting cash can certainly complicate a kiosk project, the growing number of payment channels is opening up new markets for kiosk providers as well. Bitcoin kiosks, for example, is one of the fastest-growing segments in the world due to the increased popularity of cryptocurrency. Those devices allow users to buy and sell bitcoin and similar cryptocurrencies with cash. “Our company expects to have over 1,000 Bitcoin ATMs deployed by the end of 2020,” said Brandon Mintz, CEO of Atlanta-based Bitcoin Depot. The bitcoin kiosk industry is projected to grow at a compound annual rate of 46.6 percent by 2024. Mintz’s company recently acquired competitor DFW Bitcoin. Reverse ATMs, Gift Card Kiosks and Cash2Card Opportunities There are also situations a consumer might want to convert their cash into a payment card. Maybe they want to purchase an item online and don’t wish to use (or don’t have) a credit or debit card. Maybe they want to give someone a gift, but feel that cash in an envelope is a bit tacky. Whatever the reason, Self-Service Networks caters to those consumers with its GiftWise Cash-2-Card and gift card vending kiosks. Those devices allow consumers to convert cash into a payment card, gift card or other digital asset. The opportunities for kiosks that accept cash are many, but getting the most from them requires a kiosk that is designed to accept cash, backed by a vendor who’s experienced in supporting those deployers who include those in their kiosk fleet. Olea Financial Kiosks Portfolio Olea Kiosks offers a number of kiosk models that can be customized to accept cash, print receipts, dispense tickets and more. The company’s Franklin Bill Pay Kiosk, for example, is designed to simplify cash transactions. Standard options include a high-capacity bill acceptor, bill dispenser, cash recycler options, high speed bulk note acceptor, coin dispenser, multiple biometrics and receipt printer. Olea’s Austin Kiosk is engineered for light and medium bill payment, featuring a 15” or 22” All-in-One computer in either portrait or landscape as well as an EMV credit card terminal and POS-style receipt printer. The Austin can be customized to support card issuance for gift card and Cash2Card applications. Olea can assist you with a complete range of financial services including processing, EMV payment, turnkey financial software, solution servicing, financing, cash collection services and even revenue-sharing options. We are your complete financial services partner.No matter what the challenge when it comes to accepting cash, Olea offers a payment kiosk solution to meet that challenge. Contact us at 800-927-8063 or email info@olea.com. We stand ready to help. More Information on Bill Pay Kiosks Considerations When It Comes to Bill Payment Kiosks Bill Pay Kiosks: The Business Models and Keys to Success, Part I Bill-Pay and Other Financial Kiosks The Top 3 Reasons Casino Loyalty Kiosks Can Benefit Your Casino

DENVER — The Denver Broncos, in conjunction with Aramark, formally unveiled concessions improvements at Empower Field at Mile High. They released a nice video going thru the various changes. The key changes are to increase speed of service. In the video you can see Aramark highlighting the self-order stations from Appetize (made by Olea Kiosks ). “Empower Field at Mile High is constantly looking for ways to improve the fan experience, and we are confident that with Aramark as our concessionaire we can modernize how fans enjoy food and beverages at our stadium events,” Stadium General Manager, Empower Field at Mile High, Jay Roberts said. “We are also thrilled to debut several newly renovated concession stands on Sunday, which is the first step in a multi-year process to improve speed of service while also adding more variety to the menu.” “We’re excited to expand our partnership with the Broncos and undertake this transformation of Empower Field at Mile High’s dining experience,” Jay Morrison, District Manager, Aramark’s Sports & Entertainment division, said. “We have a long, proud history of serving Denverites and, with our close ties to the community and knowledge of the local food scene, I’m confident we will deliver an innovative, dynamic and engaging food and beverage experience for everyone attending events at the stadium.” Read the full article at Denver Broncos